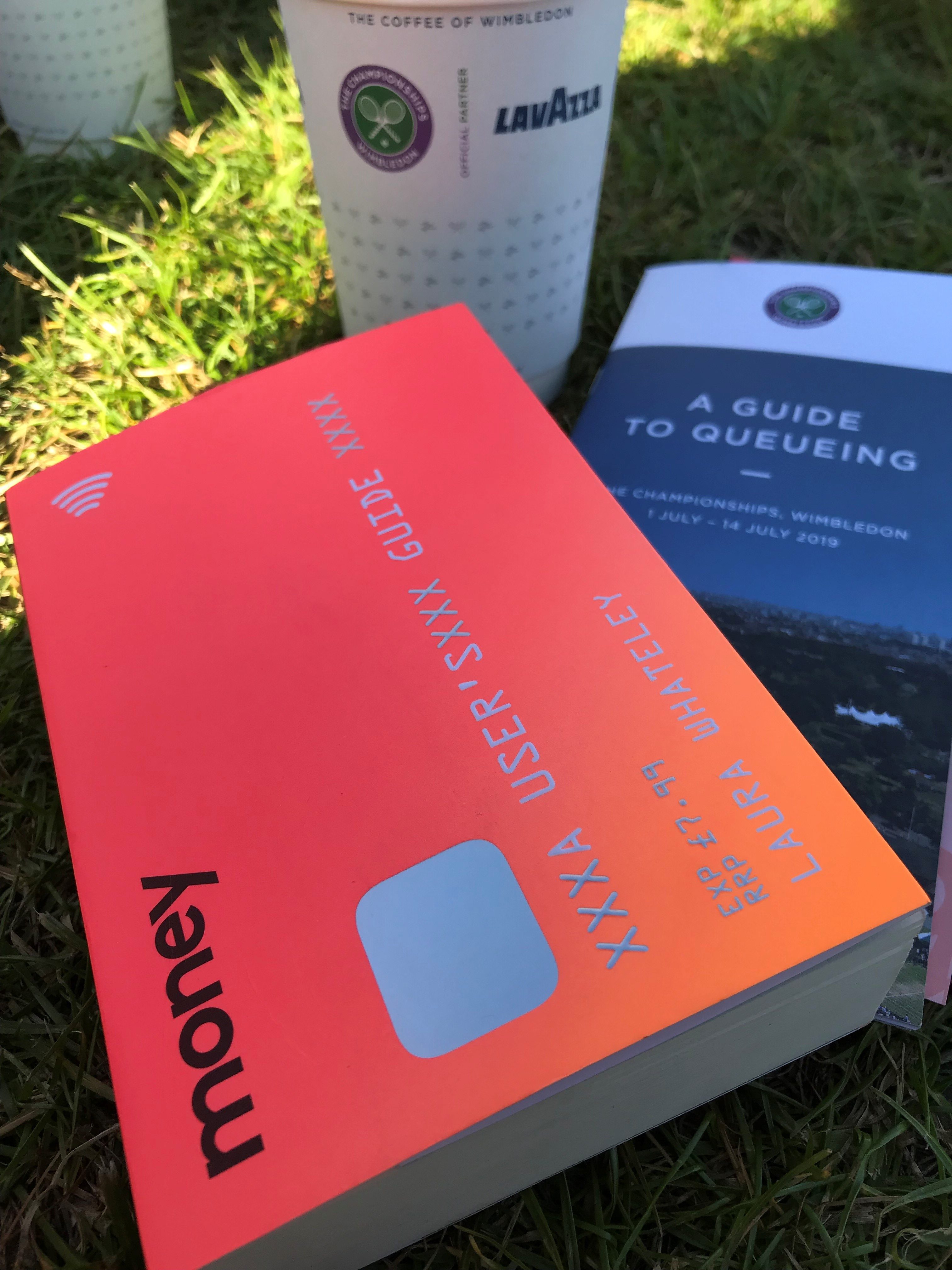

An overdraft can be a great way to boost your credit score. But if you start eating into your overdraft, this can make you look bad in the eyes of lenders. In this article we’ll be looking at what an overdraft actually is and how using it can affect your credit score.

What's Included?

What is an overdraft?

An overdraft in general terms is spending more money than you actually have in your current account. An overdraft can be arranged or unarranged. An arranged overdraft means that the bank agrees they will lend you some money if you ever empty your current account. An unarranged overdraft, on the other hand, means that the bank will charge you a fee for going overdrawn.

When we talk about “overdrafts” we’re usually talking about an arranged overdraft. Arranged overdrafts are a type of credit, since the bank usually requires you to pay a certain amount of interest on whatever you borrow. This means that to be approved for one, the bank will conduct a hard search on your credit report. It also means that your overdraft appears on your credit report for other lenders to look at.

How being in your overdraft affects credit score

Having an arranged overdraft is good for your credit score, since it indicates that your bank trusts you with certain amounts of credit. This is attractive to lenders, since this demonstrates reliability, a key aspect of reliability.

However, having an overdraft and using an overdraft are two different things. Lenders want to see that you to have an overdraft. However, if you start to use your overdraft, this indicates you are prone to emptying your bank account. Therefore, you don’t have the funds to keep up with loan repayments. This could be either out of necessity or irresponsibility.

Therefore, the best thing to do is to budget carefully to avoid dipping into your overdraft too often. A few quid here and there to cover unexpected expenses near to payday isn’t going to do too much harm. Just be wary that if you’re doing it every month, it starts to rack up. And of course, under no circumstances should you ever enter an unarranged overdraft by emptying out your arranged overdraft.

Overdraft vs credit card

You may wonder what the difference between an overdraft and a credit card is. After all, a credit card and an overdraft work almost the same way: you arrange to borrow a certain amount from a lender, and then pay it back. How come using one is good for your credit score, and it isn’t for the other?

Well, actually, this isn’t the case.

For starters, an overdraft isn’t the same as a credit card at all. Credit cards usually have cheaper rates, because you’re supposed to borrow money on a credit card. An arranged overdraft, on the other hand, is not intended to be used except in dire circumstances. Naturally, this means that overdrafts have much higher APRs than credit cards.

One high-street lender offers 39.9% APR on their overdrafts, while their credit card is just 19.9% APR.

This means that you can expect to pay more in interest on the overdraft than you would pay on the credit card.

So, a credit card is the cheaper way to borrow by a country mile!

And of course, the other thing is that a credit card is good for your credit score for the same reason that an overdraft is good for your credit score. You mustn’t use it too much, and you certainly shouldn’t use it for cash withdrawals. With a credit card, you should try not to use more than 30% of your credit limit, with 10% being ideal.

Is overdraft better than personal loan?

Personal loans might seem like a better choice than an overdraft. You can get them approved quickly. Unlike with an overdraft, the payments are regular and fixed, making budgeting easier. You can choose how long it will take you to repay them. Additionally, interest rates are usually competitive enough to get a good deal. What’s more, they usually go a lot higher than an overdraft.

However, unlike overdrafts, loans are usually not as flexible in terms of payments. Also, for small sums, interest rates can be very high. This is because lenders want to make money by lending to you, and a high interest rate can help recoup losses. (This is why payday loans often have astronomically high APRs.) Some loans are secured against collateral like your home, which puts your entire lifestyle at risk if you default. Also, overdrafts rarely have early repayment fees, but personal loans often do.

If you’re thinking of taking out a personal loan, consider whether a credit card or your overdraft might be a better way to borrow small sums.

Additionally, some credit unions offer what’s known as an “orbital loan”, which combines the best of both worlds in terms of personal loans and overdrafts, allowing you to borrow small sums of money as you would with an overdraft, but pay them back as if they were a loan.

I used my overdraft and it’s lowered my credit score! What do I do?

Don’t panic! Using your overdraft isn’t bad credit, it’s just bad practice. To get yourself back on track, pay off the balance as soon as possible. Then, budget to avoid dipping into it too much in future. Remember: Your overdraft is meant for emergency use, not immediate use.

Sign up with Credibble today to get real insight into other ways to improve your credit score. Credibble’s unique 24-Factor Credit Check tells you at a glance what you need to be doing to improve your creditworthiness. Join today for less than £10 a month.

Credibble offers two fabulous solutions.

If you’re preparing to take a mortgage, never apply until you’ve tried our unique and FREE Credibble Home app. Our smart technology will tell you what you need to fix so you avoid rejection. The app predicts when you will be able to buy, for how much and tracks your month-by-month progress to mortgage success. We’ve even added your own mortgage broker, so you get the best deals available.

More focused on your credit rating? Well, get started for free with Credibble’s 24- Factor Credit Check to truly help you improve your creditworthiness and how lenders view you. (Remember: lenders don’t use your credit score! We’ll show you what lenders look for and how to get your credit report in the best shape possible).